special tax notice irs

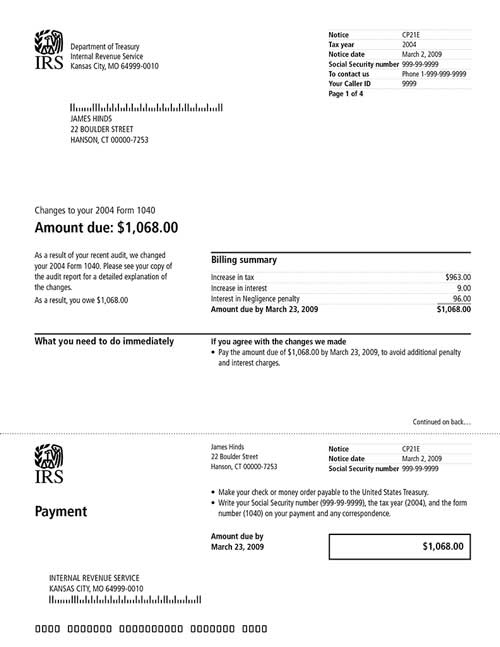

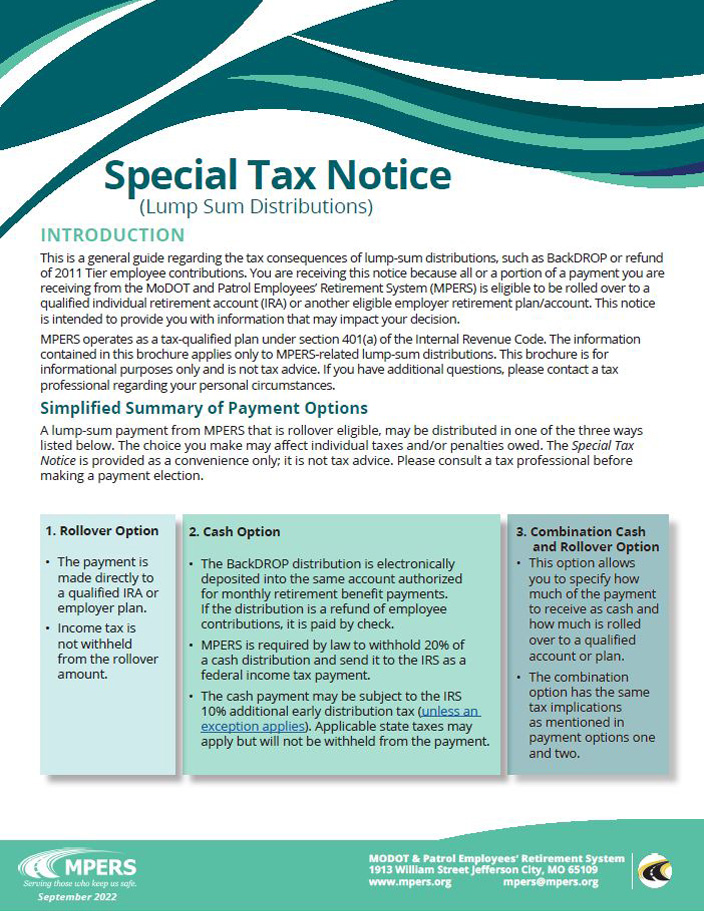

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Alternative to IRS Safe Harbor Notice - For Participant This notice explains how you can continue to defer fede ral income tax on. See IRS Form 5329 for more information on the additional 10 tax.

Trs 6 Application For Refund Special Irs Tax Notice Regarding Trs Payments Form Trs 6 Application For Refund Special Ir Fill Out And Sign Printable Pdf Template Signnow

IRS Model Special Tax Notice Regarding Plan Payments.

. Distributions from Individual Retirement Arrangements IRAs. And IRS Publication 571 Tax-Sheltered. Special Tax Notice Safe Harbor Explanations Eligible Rollover Distributions.

Limited circumstances you may be able to use special tax rules that could reduce the tax you owe. United States Office of Personnel Management. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either.

If a payment is only part of your benefit an allocable portion of your after-tax contributions is generally included in the payment. Special tax notice regarding plan payments. The rebate amount is based on an.

The South Carolina Department of Revenue SCDOR has begun issuing 2022 Individual Income Tax rebates to eligible taxpayers. This notice modifies the two safe harbor explanations in Notice 2018-74 2018-40 IRB. 572 to reflect changes made by the Economic Growth and Tax Relief Reconciliation Act of 2001 EGTRRA PL.

A9164_402f Notice 0822 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period. This notice explains how you can continue to defer federal income tax on your retirement savings in your companys 401k Plan. This requirement is deemed to be satisfied if the notice is provided to each eligible employee at least 30 days and not more than 90 days before the beginning of each plan year.

529 that may be used to satisfy the requirement under 402f of the. IRS 402f Special Tax Notice VRS Defined Benefit Plans Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from either a. However if you receive the payment before age 59½ you may have to pay an additional.

After-tax contributions included in a payment are not taxed. Was published in Notice 2000-11 2000-6 IRB. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

This week the IRS released new guidance updating the Special Tax Notice to include among other things changes enacted by the Tax Cuts and Jobs Act. This notice announces that the Treasury Department and IRS intend to amend the final regulations under 411b5 of the Code which sets forth special rules for statutory hybrid. And IRS Publication 571 Tax Sheltered Annuity Plans 403b Plans.

IRS Publication 590-B Distributions from Individual Retirement Arrangements IRAs. If your eligible rollover distribution is not rolled over it will be taxed in the year that you receive it.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Irs Audit Letter Cp14 Sample 1

Why Did I Receive An Irs Cp14 Notice In The Mail Your Guide What To Do With The Irs Cp14 Letter Get Rid Of Tax Problems Stop Irs Collections

Irs Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

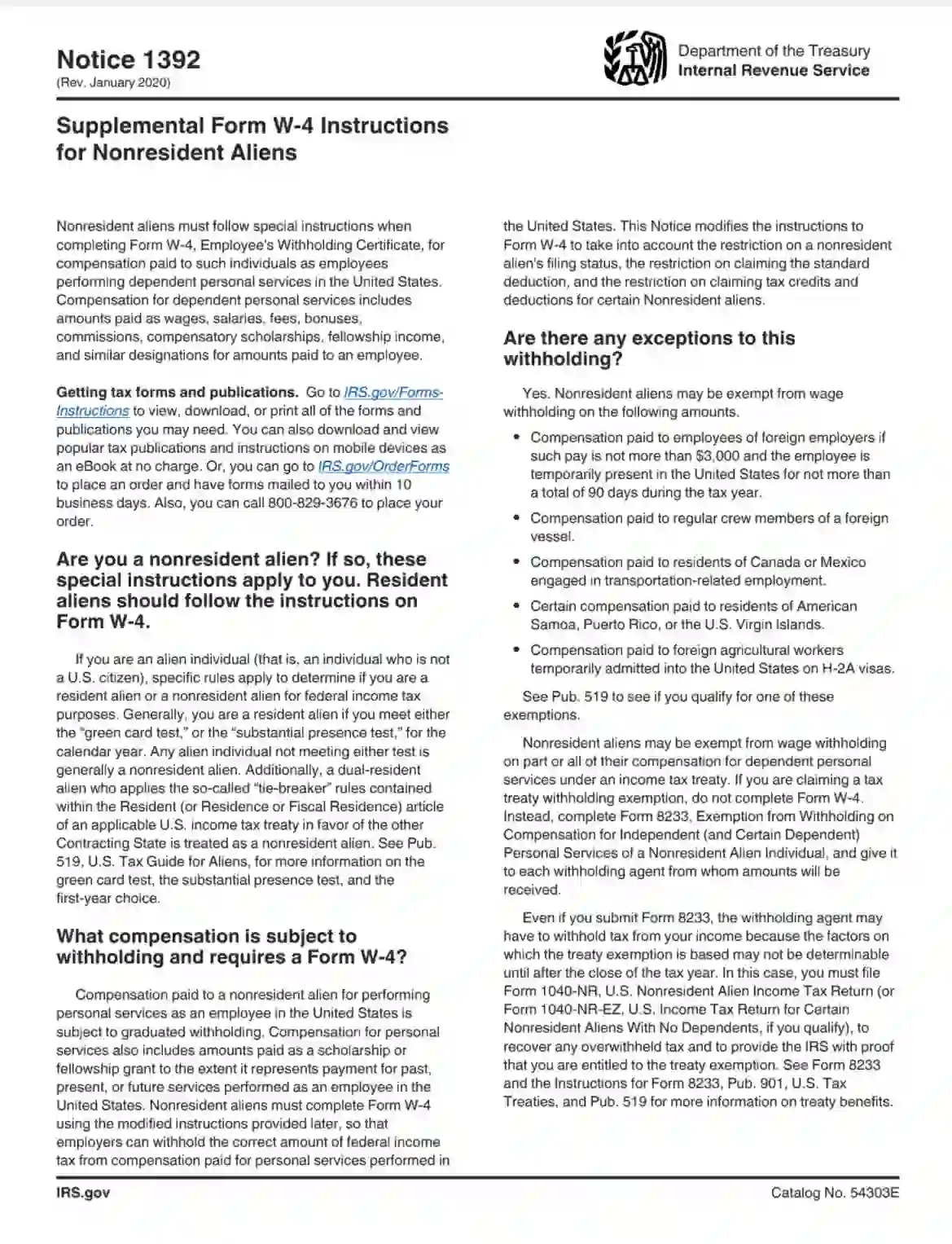

Irs Notice 1392 Fill Out Printable Pdf Forms Online

Irs Audit Letter Cp503 Sample 1

Tax Tip Notice From Irs Something Is Wrong With 2021 Tax Return Tas

Brochures Modot Patrol Employees Retirement System

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

Here S A Guide To File Your 2021 Tax Returns Wfaa Com

Irs Mailing Letters To People Eligible For Stimulus Checks Money

Irs Tax Notices Explained Landmark Tax Group

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

Responding To Irs Letters Tax Notices Alizio Law Pllc

What Is The Number On Your Irs Notice Milda Goeriz Attorney At Law